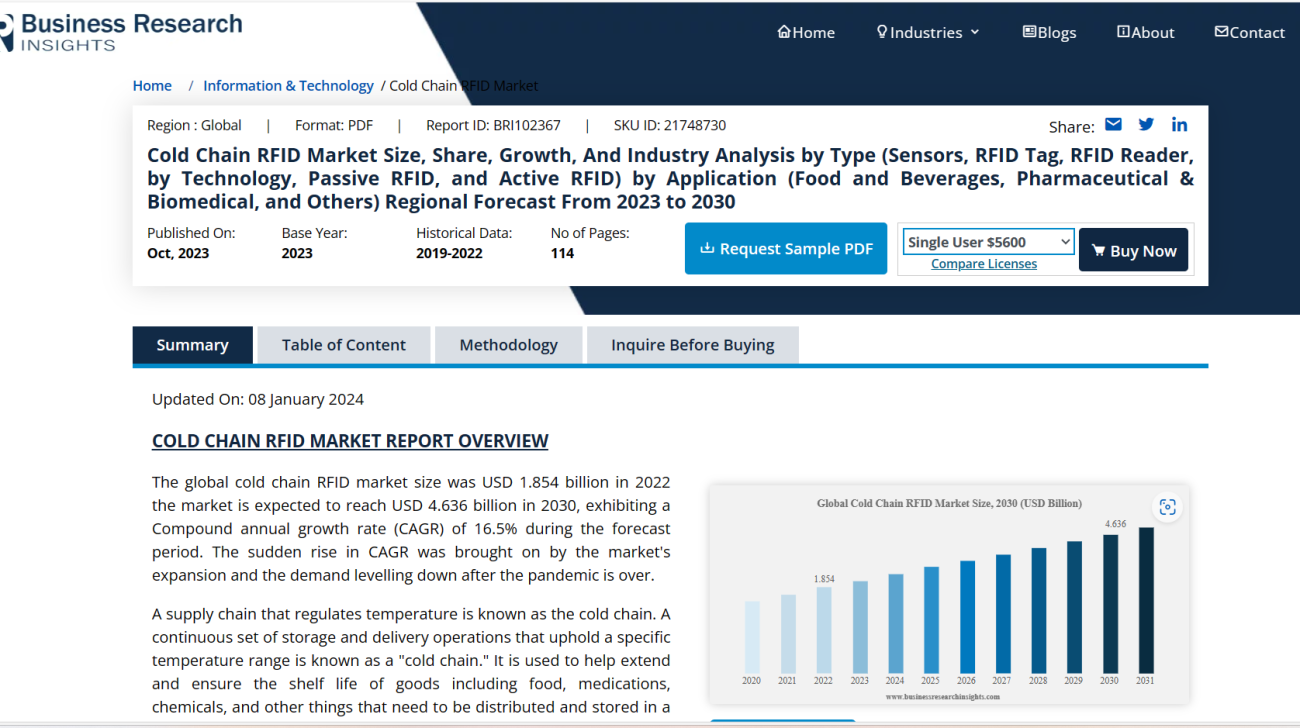

The cold chain RFID market is poised for substantial growth, anticipating a Compound Annual Growth Rate (CAGR) of 16.5% from an estimated USD 1.854 billion in 2022 to USD 4.636 billion by 2030. This surge is attributed to market expansion and demand stabilization post the COVID-19 pandemic. Essential for products like food, drugs, and chemicals, the cold chain relies on temperature-controlled storage and distribution. RFID technology plays a crucial role in tracking product flow from manufacture to sale, ensuring proper temperature control and minimizing logistics costs.

Key drivers of market growth include RFID technology advancements, with tags on products and containers facilitating efficient item tracking and temperature maintenance. Notable players in the cold chain RFID industry include Zebra Technologies, Honeywell International, Alien Technology, and others. The COVID-19 impact led to market contraction due to import/export restrictions, fostering a shift towards regional supply chains. The emergence of affordable, lighter, and smaller passive RFID tags is a recent trend, driven by large retailers adopting RFID for inventory management.

The market segments by application (Food and Beverages, Pharmaceutical & Biomedical, Others) and type (Sensors, RFID Tag, RFID Reader). Main growth drivers include the rising demand for perishable goods and RFID’s role in the Internet of Things (IoT). the high cost of RFID tags/readers and lack of industry standards. Asia-Pacific emerges as a significant market due to the demand for fresh goods and RFID technology adoption. North America experiences rapid growth driven by sector demands and RFID use in logistics. Major players employ companies like, GAO RFID Inc (Canada), alliances, new product launches, and mergers for a competitive edge.