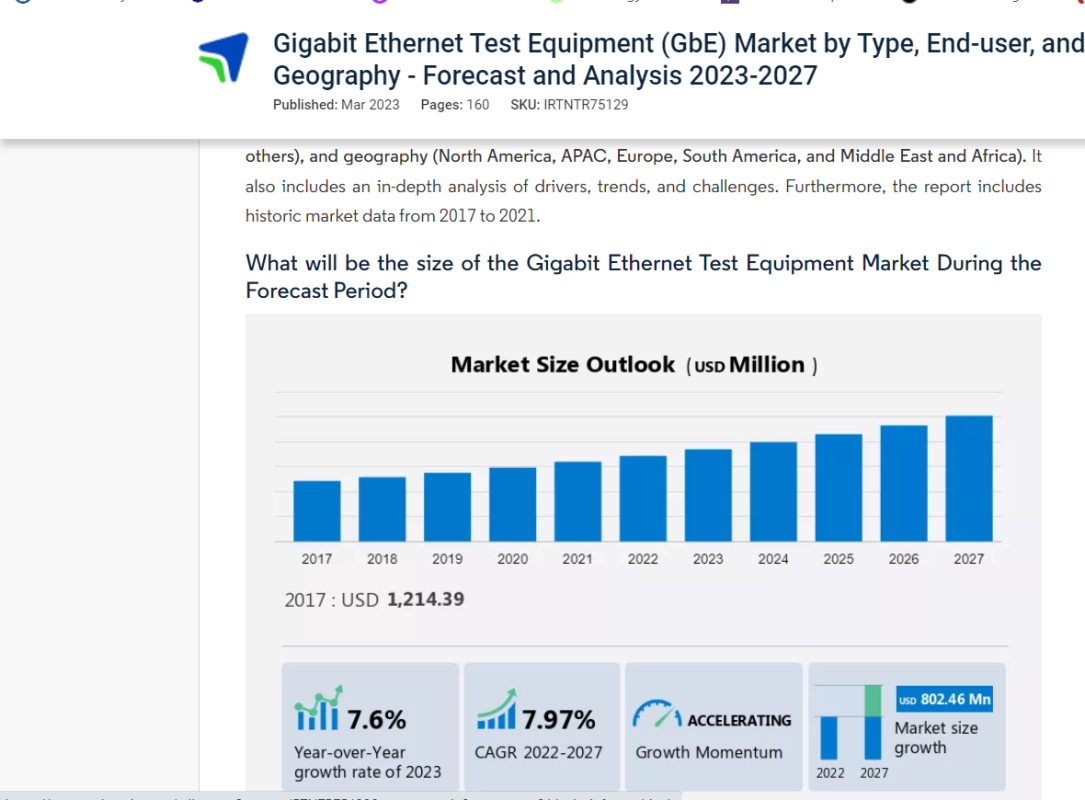

The gigabit Ethernet test equipment market is forecasted to grow at a compound annual growth rate (CAGR) of 7.97% from 2022 to 2027, reaching an expected USD 802.46 million increase. The growth is driven by factors like heightened data traffic, increasing data center numbers, and a rising demand for high-speed Ethernet. The market is segmented by type, end-users, and geography, offering a detailed analysis.

The growing demand for high-speed Ethernet, propelled by the introduction of 400 GBE standards and approval of 40 GBE and 100 GBE standards. Notable product releases, like Spirent Communications’ M1 Appliance, contribute to enhanced data capacity and faster network speeds. However, the shift towards wireless communication poses a challenge, especially in wired networks.

The paper explores adoption rates across locations, covering the adoption lifecycle and factors influencing price sensitivity. Major industry players, such as GAO RFID, Agilent Technologies, Anritsu Corp., and Spirent Communications Plc, adopt various strategies like alliances and mergers to strengthen their market position.

The 10 GBE sector is expected to be the fastest-growing, driven by affordability and ease of data management. North America, particularly the United States, is projected to contribute significantly (34%) to global market growth due to widespread internet adoption, increasing data traffic from 5G, AI, and IoT applications, and the presence of leading cloud computing companies. The report provides a comprehensive forecast of market growth globally, regionally, and nationally, along with a parent market analysis categorizing manufacturers in the global gigabit Ethernet test equipment market within the broader communications equipment industry. External factors influencing the growth of the parent market during the forecast period are extensively covered in the study.